2024: Risk & Compliance Salary Guide

The future of Financial Crime presents a complex and evolving landscape, shaped by technological advancements and shifting regulatory frameworks.

Whilst it is challenging to predict with certainty, several key trends are likely to shape Financial Crime in the coming years. So, what are the trends?

Cybercrime and Technological Innovation: As banks and financial institutions embrace digital transformation, cybercriminals are finding new opportunities to exploit vulnerabilities in digital systems. Advanced cyber-attacks, including ransomware, phishing scams, and data breaches, are expected to increase. We have seen emerging technologies such AI, blockchain, and cryptocurrency present both opportunities and challenges for combating Financial Crime.

Cross-Border Threats: The interconnected nature of the global financial system facilitates cross-border Financial Crime, including money laundering, terrorist financing, and sanctions evasion. Criminal networks operate seamlessly across jurisdictions, exploiting regulatory gaps and jurisdictional differences to evade detection and prosecution.

Regulatory Scrutiny and Compliance Challenges: Regulatory scrutiny of financial institutions is expected to intensify in response to emerging risks and evolving regulatory standards. Regulators are imposing tighter requirements on banks and other financial firms to enhance transparency, accountability, and Compliance with AML and KYC regulations. Compliance costs are likely to rise as banks invest in enhanced AML/KYC controls, technology infrastructure, and staff training to meet regulatory expectations.

Environmental, Social, and Governance (ESG): Environmental, social, and governance (ESG) factors are gaining prominence in the financial industry, driven by investor demand for sustainable and responsible investment practices. Financial institutions are under pressure to assess and mitigate ESG-related risks, including money laundering, corruption, human rights abuses, and environmental crimes. As ESG considerations become integral to risk management and investment decision-making, banks must incorporate ESG criteria into their AML/KYC processes and due diligence procedures to identify and address emerging risks associated with unsustainable or unethical business practices.

Summary: The future of financial crime is going to be led by technological innovation, regulatory scrutiny, and evolving risk landscapes. Banks and financial institutions must remain vigilant, adaptive, and proactive in combating Financial Crime, leveraging advanced technology, collaboration with regulators and law enforcement agencies, and a commitment to ethical conduct and Compliance to safeguard the integrity and stability of the global financial system.

Looking to speak with a Financial Crime specialist? Please get in contact with Taylor Catton at taylor@theriskpartners.com

We get calls every day from individuals discussing their career to date and current / former employers. It got me thinking, what does make a good employer these days?

I don’t think “free lunch” or “complimentary fruit basket” can really cut it in 2024. So, lets stick to the important issues . . . . . .

Positive Work Culture: A positive work culture is a “safe space”, one that promotes a supportive, collaborative, and respectful work environment. Employers that prioritize their employees’ well-being, provide opportunities for growth and development, and encourage work-life balance are much more likely to develop a happy, positive culture. In turn making people feel valued and appreciated, making staff retention less of an issue.

Competitive Compensation and Benefits: Employers that offer competitive salaries, bonuses, and tertiary benefits packages attract and retain top talent. Simple.…………there is no magic formula to this one. We live in a world where the cost of living is high. Stop making employees look for ‘greener pastures’ by paying them fairly. (Note: This isn’t all about cash . . . other benefits are important too – e.g. healthcare, retirement plans, flexible work arrangements etc)

Opportunities for Advancement: Employees are more likely to remain engaged and committed to their employer if they have opportunities to advance their career. Employers that offer clear paths for career advancement, mentorship, and professional development will attract new staff and keep existing staff motivated.

Strong Leadership: Effective leadership is critical to creating a positive work environment. Employers that demonstrate strong leadership through clear communication, a focus on employee development, and a commitment to the organization’s mission and values can inspire employee engagement and loyalty.

Commitment to Diversity and Inclusion: A big topic and very important topic. Employers that prioritize diversity and inclusion foster a culture of respect, understanding, and belonging. Organizations that embrace diverse perspectives and backgrounds can benefit from increased innovation, creativity, and productivity. We are all different, with different strengths & weaknesses. Lets make the most of what we each have to offer!

Work-Life Balance: Employers that provide flexible work arrangements, such as remote work options, flexible schedules, or generous time off policies, can help employees achieve a healthy work-life balance. Employers that prioritize their employees’ well-being demonstrate a commitment to creating a sustainable work environment.

What do you think? Have I missed anything?

Rob Starkl

Managing Partner

In the ever-changing landscape of Financial Services, Risk Management stands as a cornerstone, ensuring stability, resilience, and compliance in an ever-evolving environment.

As technology continues to reshape industries, the future of Risk Management in Financial Services promises to be both transformative and essential. From advanced analytics to regulatory evolution, let’s delve into the key trends shaping this critical aspect of the financial sector:

**1. Data-Driven Decision Making:**

Data has emerged as the lifeblood of modern risk management. Advanced analytics, machine learning, and artificial intelligence empower financial institutions to harness vast amounts of data for predictive modeling, scenario analysis, and risk forecasting. By leveraging real-time data streams and sophisticated algorithms, institutions can anticipate and mitigate risks more effectively, enhancing their ability to adapt to changing market conditions.

**2. Cybersecurity Imperatives:**

With the proliferation of digital transactions and the rise of cyber threats, cybersecurity has become a paramount concern for risk management. Financial institutions must continually fortify their defenses against cyber attacks, employing robust encryption, multi-factor authentication, and proactive threat intelligence to safeguard sensitive data and preserve customer trust. Additionally, advancements in blockchain technology hold promise for enhancing security and transparency in financial transactions, further bolstering risk management efforts.

**3. Regulatory Complexity:**

Regulatory requirements continue to evolve in response to emerging risks and market dynamics. Financial institutions must navigate a complex regulatory landscape, ensuring compliance with stringent guidelines while striving to maintain operational efficiency. RegTech solutions, powered by AI and automation, offer a compelling approach to streamlining regulatory compliance processes, enabling institutions to efficiently manage compliance obligations and reduce regulatory risk.

**4. Climate and ESG Risks:**

Environmental, Social, and Governance (ESG) considerations are gaining prominence in risk management practices as organizations seek to address climate-related risks and meet stakeholder expectations for sustainable business practices. Integrating ESG factors into risk assessments enables financial institutions to identify and mitigate exposure to environmental and social risks, while also seizing opportunities for sustainable investment and growth.

**5. Resilience and Business Continuity:**

The COVID-19 pandemic underscored the importance of resilience and business continuity planning in risk management. Financial institutions must proactively assess and mitigate operational risks, including supply chain disruptions, cyber threats, and geopolitical uncertainties, to ensure business continuity in the face of unforeseen challenges. Embracing digital transformation and cloud-based technologies can enhance operational resilience, enabling organizations to adapt and thrive in volatile environments.

**6. Collaborative Risk Management:**

As risks become more interconnected and systemic, collaboration among financial institutions, regulators, and industry stakeholders is essential for effective risk management. Information sharing, industry benchmarks, and collaborative initiatives facilitate a collective approach to identifying and addressing emerging risks, strengthening the resilience of the financial system as a whole.

**Conclusion:**

The future of risk management in financial services is characterized by technological innovation, regulatory evolution, and a heightened focus on sustainability and resilience. By embracing data-driven decision-making, fortifying cybersecurity defenses, navigating regulatory complexity, addressing climate and ESG risks, prioritizing resilience and business continuity, and fostering collaborative risk management practices, financial institutions can effectively navigate the complexities of an increasingly interconnected and dynamic risk landscape, safeguarding their operations, stakeholders, and long-term viability in an uncertain world.

If you are looking for the next job opportunity or for the right people to join your team, please get in touch with me directly, today

Thank you for reading

Rob Starkl

Managing Partner – The Risk Partners

rob@theriskpartners.com

Attracting a diverse workforce is a key focus for many organizations across the globe. Here are some strategies that can help your recruitment process:

1. Review your job descriptions and postings: Make sure your job descriptions are free from bias and do not exclude certain groups. Use gender-neutral language and avoid phrases that may be seen as discriminatory.

2. Use a variety of recruiting channels: Expand your recruiting channels beyond traditional sources. Consider posting job openings on social media, partnering with community organizations, and attending career fairs.

3. Make diversity a priority: Demonstrate your commitment to diversity by creating a diversity and inclusion statement and incorporating it into your company’s values and culture.

4. Provide diversity training: Provide training to your employees on diversity and inclusion to promote awareness and understanding of different cultures and perspectives.

5. Offer flexible work arrangements: Offer flexible work arrangements, such as telecommuting, flexible schedules, or job sharing, to help attract candidates with diverse needs and backgrounds.

6. Promote diversity at all levels: Ensure that diversity is represented at all levels of your organization, including in leadership roles.

7. Consider blind CV’s when hiring: Consider using blind hiring techniques, such as removing identifying information from resumes and conducting blind auditions, to help eliminate bias in the hiring process.

By implementing these strategies, you can create a more inclusive workplace culture and attract a more diverse pool of candidates.

If you are looking to hire in your team, please get in touch today: contact@theriskpartners.com

General Observations

The Risk job market has had a stronger start to 2024 than 2023. Last year there was a notable decline in the number of new roles coming to market for Risk professionals, part of a common trend across the Financial Services sector as a whole.

Whether that was a reaction to over hiring in 2022, or a determination on cost control across (or a mixture of both), it did not soften the regulatory spotlight and the demand for Risk talent strengthened in the second half of 2023. That trend has continued into 2024.

On the supply side, many job seekers have become more cautious when it comes to considering their next move, probably a direct result of the job losses across the Financial Services industry and the cost-of living crisis. That places more emphasis on employers to put prospective employees’ minds at ease, during the interview process, of their business performance and stability. While compensation and hybrid arrangements continue to be the key motivators, we are also seeing a notable increase in mid-senior professionals who are concerned about burnout. This is usually down to insufficiently staffed teams, leading to sustained long hours and weekends, with no prospect of things getting better. Also, cultural issues at companies where there are continuous pivots in strategy, meaning hectic workloads and unrelenting change.

International banks are hiring junior-mid-level Risk professionals sporadically, while domestic banks are notably quiet. Payments/ Fintech & Crypto companies continue to be the most active participants, as they build out their teams or replace people who are not suited to their cultures.

Skills in demand

This year has started with more activity in general, rather than the trends of the previous two, when the demand for Risk Managers came from the Commodities sector in 2022 and last year the strongest demand was for Credit Risk professionals. This year the demand comes broadly from all risk disciplines. That said Credit Risk managers and Non-Financial Risk professionals, particularly outsourcing & business resilience, are more in demand than their peers in other Risk stripes.

Sample of recent successful assignments

The Risk Partners are a boutique recruiter, with Corporate Governance (Risk, Compliance, Legal) at the heart of its activities. We live in a world where Governance steers the world through often challenging times.

Our aim is to work in partnership to develop careers and find business solutions. Please get in touch to discuss how we can help you. contact@theriskpartners.com

Market Intel: Credit Risk Modellers / Quants

Date: January 2024

Sector: Retail / Consumer / Asset Finance / Corporate Banking

Key areas considered: Credit Risk Modelling, Model Validation, Model Governance

Salary guide:

| Amount of experience | Grading | Base Salary (London) | Base Salary (Regional) |

| 15+ | Managing Director | £150k – £200k | £130k + |

| 10 – 15 years | Director | £120k – £150k | £100k – £130k |

| 7 – 10 years | VP | £90k – £110k | £80k – £100k |

| 5 – 7 years | AVP | £75k – £90k | £65k – £80k |

| 3 – 5 years | Senior Analyst | £60k – £75k | £55k – £65k |

| 1 – 3 years | Analyst | £45k – £60k | £40k – £50k |

| 0 – 1 years | Graduate | £40k – £45k | £35k – £40k |

Market intel

For more information about finding a new position, or if you are looking to hire, please get in touch with us at contact@theriskpartners.com

What is happening in Credit Risk within the London market?

For more information please contact rob@theriskpartners.com

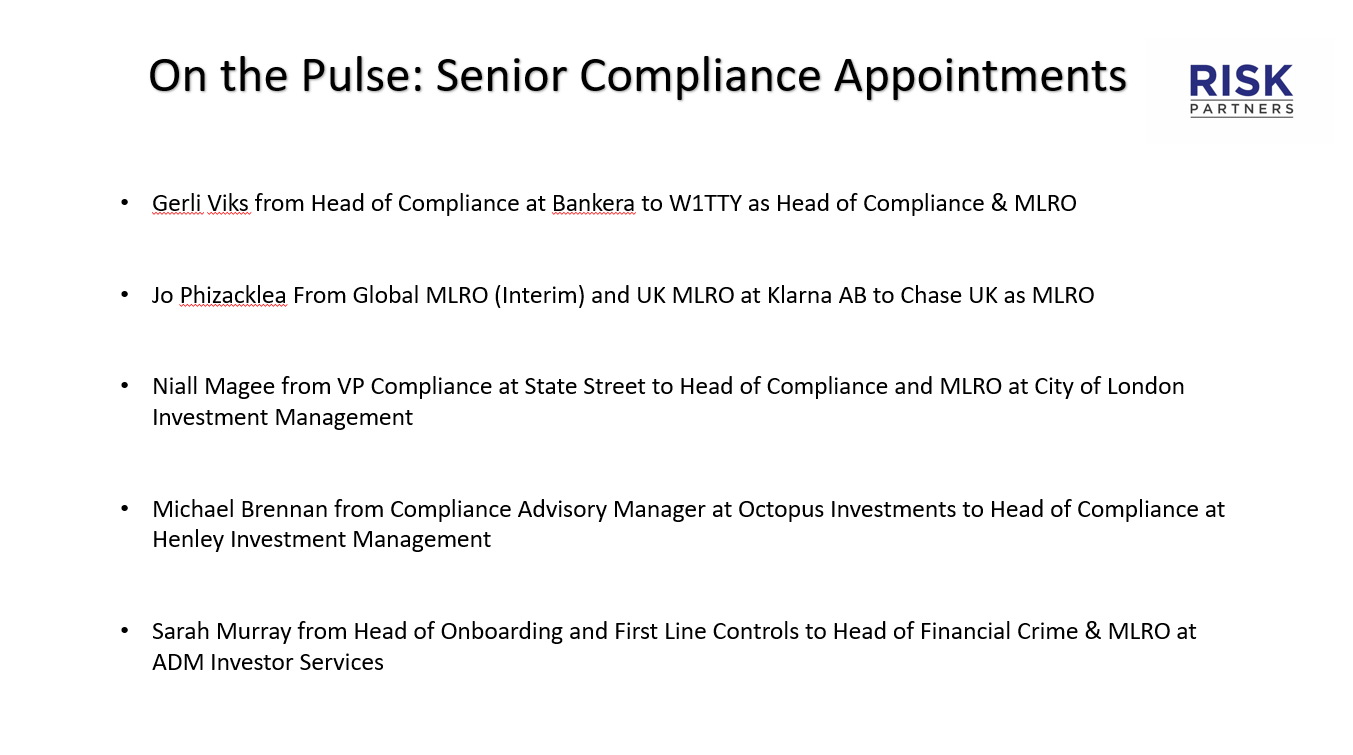

Congratulations to all on the list on your new positions!

For more information about us or about hiring for your Compliance team, please email: contact@theriskpartners.com

#theriskpartners #onthepulse #seniorappointments #Compliance

Recently, the world has seen a couple of high-profile Banks run out of money and fail.

Everyone has heard the expression that Banks are “too big to fail”, so how does his happen?

1. Poor Risk Management: Banks can fail if they take on too much Risk on their investments / lending, without proper Risk Management controls in place. This can lead to significant losses, such as the ones experienced during the 2008 financial crisis. In this case, risk controls and due diligence in the housing market were not tight enough.

2. Inadequate Capital: Banks need to have sufficient capital to absorb potential losses (a buffer if you like). If they have inadequate capital, they may not be able to absorb losses caused by macroeconomic affects or ‘bad investments’ and may be forced to close.

3. Economic downturns: Economic downturns, such as recessions, can lead to increased loan defaults and decreased demand for banking services, which can result in significant losses for Banks. If customers cant pay back their Loans (Mortgages, Credit Cards, Car Finance etc) or Companies that borrow money go bust, the movement of money stops.

4. Fraud or misconduct: Banks can fail if they engage in fraudulent activities or other misconduct that erodes customer trust and results in significant financial losses. Banks now investment sizable sums of money in divisions such as Anti-Fraud, KYC teams (Know Your Customer) or AML (Anti-Money Laundering) to prevent this from happening.

5. Poor Governance: A subject close to our heart here at The Risk Partners! Banks can fail if they have poor Governance structures in place, such as weak Board oversight, inadequate risk management practices, or inadequate internal controls. If a firm is not policing its own activities, it can be a recipe for disaster.

6. Regulatory issues: Banks can fail if they fail to comply with regulatory requirements, such as capital adequacy and liquidity requirements, or if they engage in illegal or unethical practices. The rules of the game are established and can be viewed by anyone. Fall foul of the FED, PRA or EBA, significant penalties are coming your way!

In summary, Banks can fail for a variety of reasons and the above are just a selection.

Our job is to find your Financial Services business the talent required to stop your firm from falling into difficulties.

The Risk Partners are a boutique specialist recruiter, with Risk Management at its heart of its activities. We live in a world where Governance steers the world through often challenging times. Our aim is to work with clients to ensure that you find the right people for your business. Please get in touch to discuss how we can help you.